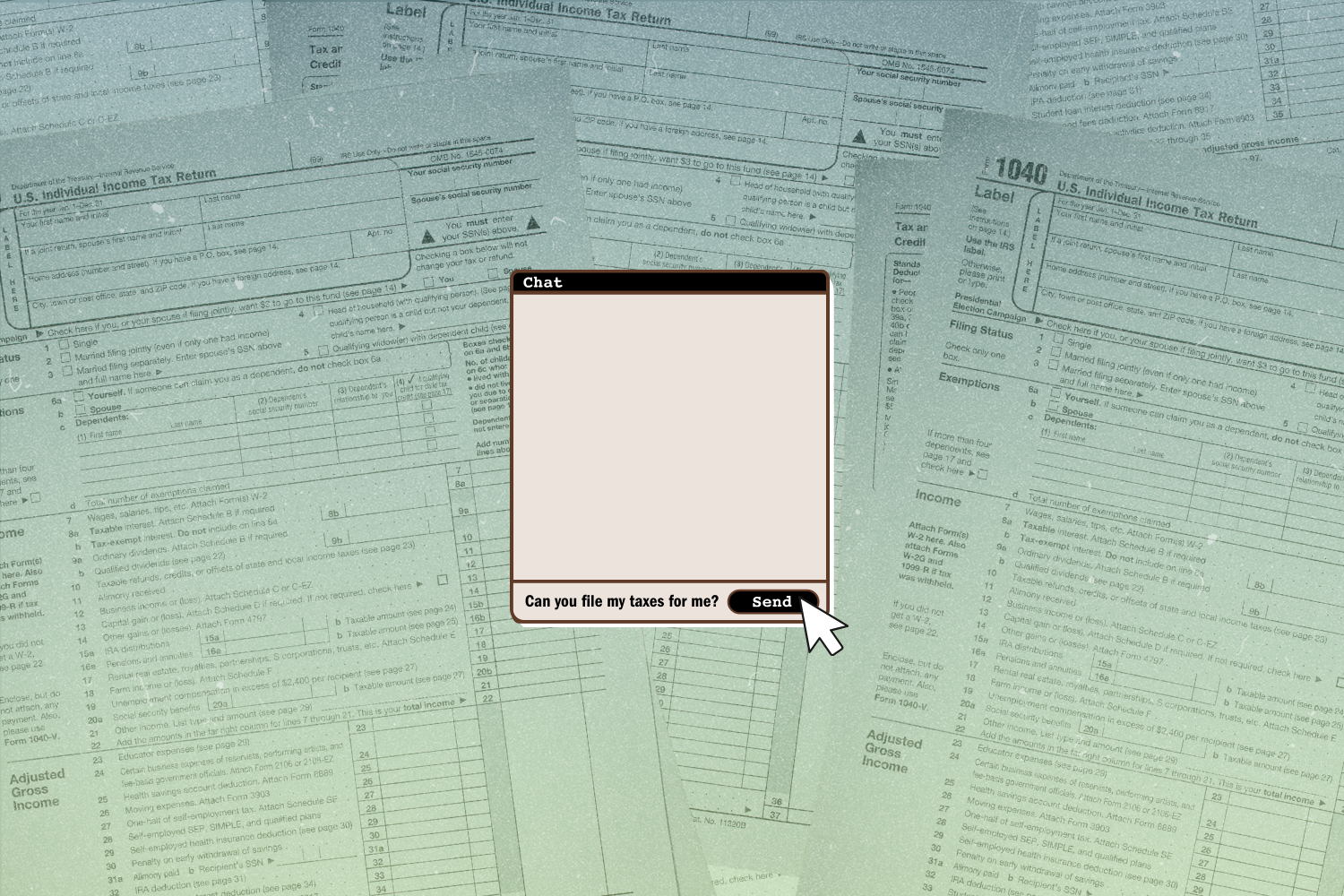

AI technologies are being integrated into tax software to automate repetitive tasks, identify tax breaks, and address compliance risks. This is expected to simplify the tax-filing process for individuals, who currently spend an average of 13 hours and $240 to prepare and file their tax returns. However, the accuracy and reliability of AI tax tools have come into question, with instances of chatbots providing incorrect answers to simple tax inquiries. As a result, tax experts advise against relying solely on AI tools for filing taxes this year. Despite these challenges, it is predicted that AI will revolutionize the tax industry in the coming years.

One of the major benefits of using AI in tax software is the ability to streamline the coding of tax laws, making it more efficient and cost-effective for companies to develop and improve their products. Ben Borodach, co-founder and CEO of the AI tax startup April, emphasizes that AI technology allows for faster development of tax software, enabling new providers to enter the market with superior products and services. This increased competition is expected to drive innovation and enhance the overall quality of tax software available to consumers.

The Internal Revenue Service (IRS) is also leveraging AI technologies to improve its operations and enhance taxpayer services. The IRS, facing budget constraints and a backlog of inquiries, has been granted $80 billion by President Biden to invest in AI solutions. These investments are aimed at improving the efficiency of IRS operations, reducing processing times, and providing more timely and accurate responses to taxpayer questions. By incorporating AI into its processes, the IRS hopes to enhance compliance and enforcement efforts while also improving the taxpayer experience.

Despite the potential benefits of AI in tax software, concerns remain about the accuracy and reliability of AI-powered tools. Inaccurate responses from AI chatbots have raised doubts about the ability of these tools to provide accurate tax advice and assistance. Tax experts caution against relying solely on AI tools for filing taxes, emphasizing the importance of consulting with a professional to ensure compliance and accuracy. While AI has the potential to transform the tax industry, it is important to approach these technologies with caution and skepticism to avoid costly errors and penalties.

In conclusion, AI technologies are revolutionizing the tax industry by automating tasks, improving efficiency, and enhancing taxpayer services. While there are concerns about the accuracy and reliability of AI tax tools, companies like April are leveraging AI to develop innovative solutions that simplify the tax-filing process. The IRS is also investing in AI technologies to enhance its operations and provide better services to taxpayers. As AI continues to evolve, it is expected to have a significant impact on the way taxes are filed and managed, ultimately benefiting both taxpayers and tax professionals.