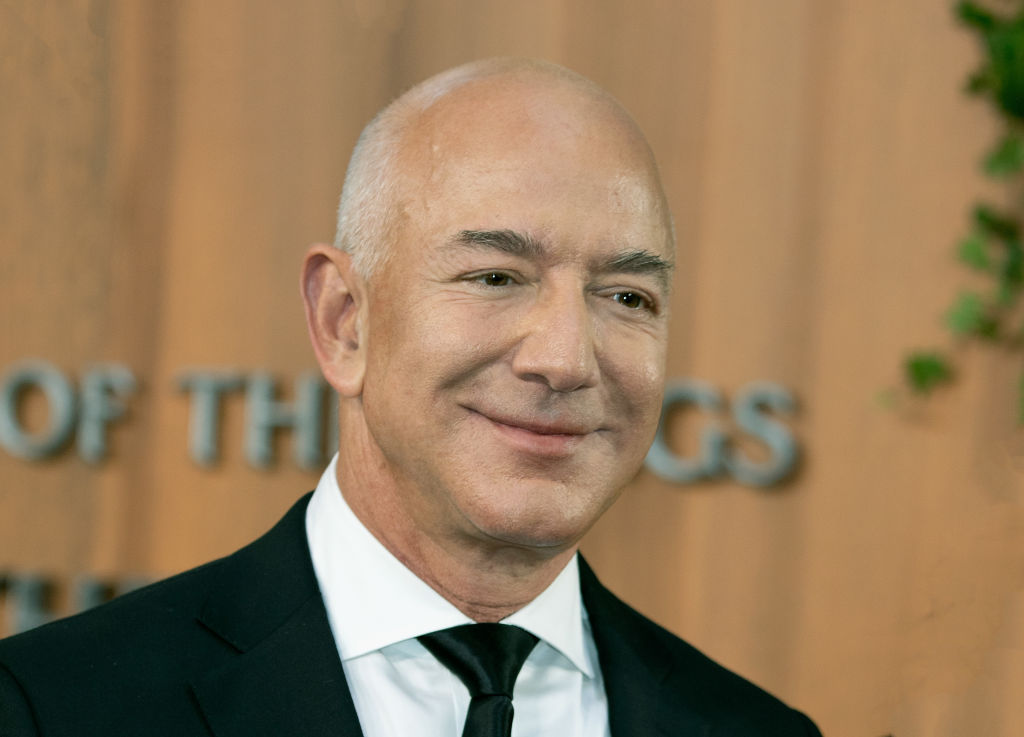

Jeff Bezos recently sold 14 million Amazon.com Inc. shares worth approximately $2.4 billion, completing a plan he had disclosed earlier in the month to sell up to 50 million shares in just nine trading days. This latest transaction brings his total cash out to $8.5 billion and took place over three trading days, ending on Tuesday, according to a regulatory filing. Prior to this selling spree, Bezos, who is the world’s third-richest person, had not disposed of company stock since 2021. Bezos is the founder of Amazon and also owns Blue Origin, a space exploration company, and the Washington Post.

Despite not disclosing plans for the proceeds from the sale of his Amazon shares, Bezos announced on November 2nd that he was moving from the Seattle region to Miami. The state of Washington implemented a 7% capital gains tax in 2022, which Florida does not have. Bezos’s relocation to a state without a capital gains tax is likely saving him hundreds of millions of dollars in taxes. Bezos currently has a net worth of $191.3 billion, according to the Bloomberg Billionaires Index.

Spokespeople for Amazon and Bezos have not provided immediate comments or responses to requests for information regarding Bezos’s recent stock sales and relocation to Miami. Bezos’s decision to sell a significant portion of his Amazon shares and move to a state without a capital gains tax has drawn attention due to the substantial amount of money involved. Bezos has been a prominent figure in the business world, having founded one of the largest e-commerce companies in the world and expanding his interests to include space exploration and media.

The rapid pace at which Bezos sold his Amazon shares, completing the sale of 14 million shares in just nine trading days, reflects his ability to make significant financial decisions quickly. Bezos’s decision to sell a portion of his Amazon holdings may be part of a larger financial strategy, though his specific plans for the proceeds remain undisclosed. As one of the wealthiest individuals in the world, Bezos’s actions and financial decisions are closely watched and analyzed by investors, analysts, and the public.

Bezos’s sales of Amazon shares and relocation to Miami highlight the complex tax strategies employed by wealthy individuals to minimize tax liabilities. By moving to a state without a capital gains tax, Bezos is able to retain a larger portion of the proceeds from his stock sales. As Bezos continues to make headlines for his business ventures and financial decisions, his actions serve as a reminder of the significant impact that individuals with immense wealth can have on the financial markets and tax policies.