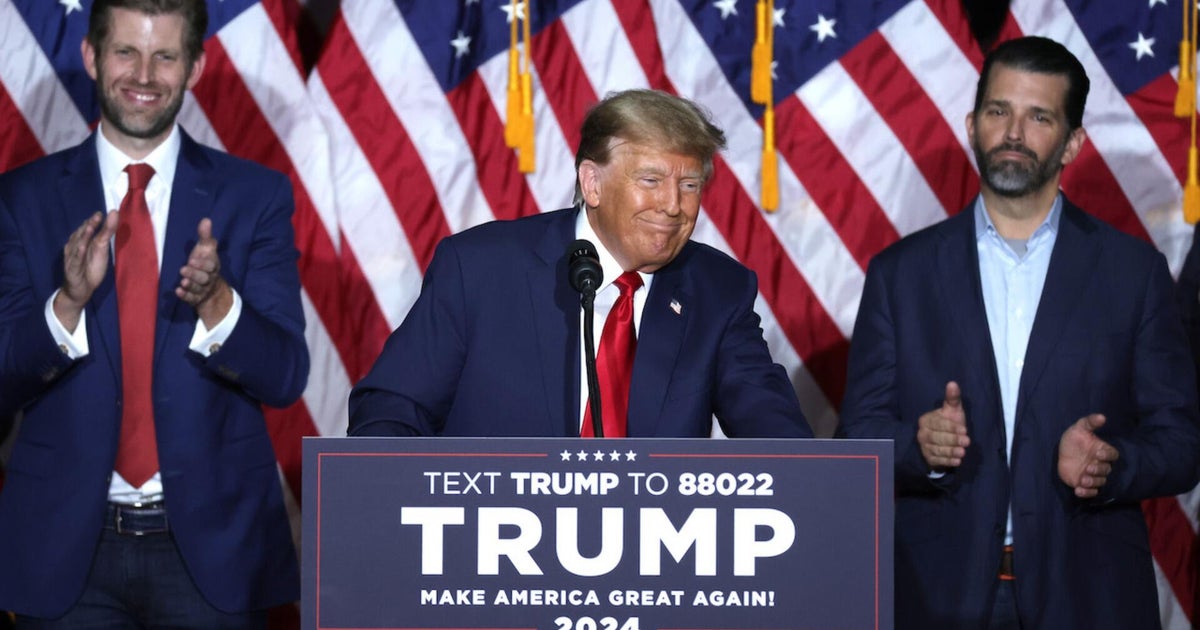

The ascendancy of President Donald Trump to the Oval Office for a second term has had enormous implications across a myriad of sectors. An arena that has conspicuously flourished during the initial phase of his presidency is the cryptocurrency sector. This segment of the financial landscape, often characterized by its mercurial nature and burgeoning technology, has felt a tangential boost under Trump’s administration. However, it’s not just the broader market that has sensed momentum; specific entities within the crypto world have also perceived a pronounced impact – notably those with direct ties to the President’s familial circle. Such connections have stirred conversations and concerns over potential conflicts of interest.

President Trump’s first 100 days have marked substantial administrative maneuvers that have indirectly and, in some cases, directly influenced sectors like cryptocurrency. Crypto firm XYZ, which is notably affiliated with the Trump family, has drawn particular attention and scrutiny amidst these developments. The firm’s proximity to political power could potentially lead to preferential regulatory treatments or insights, sparking unease regarding the fairness and transparency within the sector fostered by such affiliations.

Jo Ling Kent, a seasoned financial journalist, delves into the intricacies of this situation in her report, highlighting the potential ramifications of XYZ Crypto’s close association with the Trump family. Through comprehensive interviews and meticulous document reviews, Kent exposes layers that might suggest conflictual benefits stemming from this affiliation.

The backdrop of the report is a broader conversation about the intersection of political influence and business advantages in Washington, D.C. Kent points out that while the cryptocurrency market typically reacts to technological advancements and regulatory news, the influence of high-profile political endorsements or affiliations cannot be underestimated. The meteoric rise in XYZ’s operations, particularly in synchrony with Trump’s tenure, raises flags around whether current governmental stances on cryptocurrencies are entirely impartial or bent towards familial or associative gains.

In Kent’s detailed analysis, she explores how the crypto firm has taken strategic steps to align itself closely not just with the ethos and business strategies beneficial under Trump’s policies but also with key individuals who are directly connected to the administration. This has included hiring lobbyists with former ties to the Trump campaign and employing executives at XYZ who formerly served in Trump-related business ventures.

XYZ’s strategic maneuvers around compliance issues, lobbying efforts, and the roles of advisors who oscillate between the crypto firm and government advisory positions are laid out with succinct clarity in the report. Kent questions whether XYZ’s regulatory foresight could be attributable to conventional business acumen or privileged insights gained through its political connections. This gray area features prominently in her probe as she seeks to uncover the layers of influence and information exchange that may have fortified XYZ’s market position.

Moreover, Kent elucidates the potential conflicts of interest inherent in such relationships. There are concerns that political figures could unduly influence the thriving industry’s trajectory to benefit personal or familial investments. Such dynamics pose significant ethical dilemmas and could compromise the perceived integrity of governmental decisions regarding the sector. The journalist outlines not only the direct impacts on market confidence and investment behaviors but also the long-term implications for policy formation concerning digital currencies.

Legal experts interviewed by Kent discuss the existing frameworks governing such associations and the possible legal and ethical breaches that might occur if government insiders possess stakeholdings in or receive benefits from crypto enterprises like XYZ. Discussions focus on the need for robust transparency mechanisms and stricter regulations to curtail any undue advantage that might arise from such close associations with power corridors.

Kent’s narrative is interspersed with reactions from various stakeholders within and outside the crypto community. From blockchain enthusiasts who cheer any news that might boost the industry, to skeptics who fear the undermining of sectoral integrity, the report captures a spectrum of perspectives. Additionally, the story pays attention to investor confidence, drawing links between public perceptions of XYZ’s operation vis-à-vis its proximity to the Trump administration and the broader health of the digital currency markets.

Furthermore, the report doesn’t shy away from the global context wherein different countries are at varying stages of embracing or regulating cryptocurrencies. It positions the U.S. — under Trump’s leadership and with cases like XYZ — as a key narrative player in the global discourse of political power’s influence on burgeoning tech sectors.

In conclusion, Jo Ling Kent’s comprehensive report not only shines a spotlight on the particular instance of XYZ but also catalyzes a broader debate on the ethics of political affiliations in rapidly evolving tech industries. As Trump’s administration progresses, all eyes will remain on how these entanglements unfold and what precedents they set for future interactions between politics and industry innovations.