The Biden administration has recently announced the cancellation of federal student loans for an additional 55,000 workers through the Public Service Loan Forgiveness program. This initiative targets individuals such as teachers, nurses, service members, law enforcement officials, and others who have met the eligibility requirements of the program, which promises to eliminate loans after 10 years of service in government or nonprofit roles.

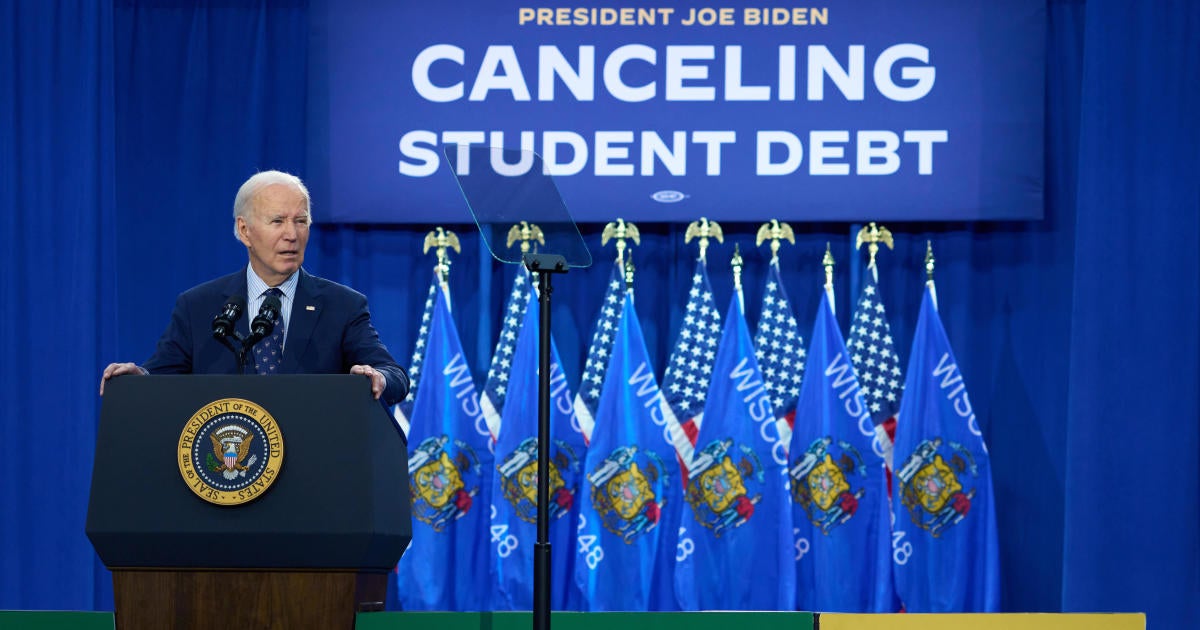

This latest round of relief, totaling $4.28 billion, is expected to be the final phase of public service loan forgiveness before President Biden’s term concludes in January. Despite facing challenges in fulfilling his promise of widespread loan cancellation, President Biden has instead focused on expanding loan relief through existing programs that were established prior to his presidency.

Under President Biden’s leadership, the Education Department has made efforts to streamline the rules for Public Service Loan Forgiveness, which previously had a 99% rejection rate due to complex regulations and widespread confusion surrounding eligibility criteria. With this most recent round of relief, President Biden has now canceled a record-breaking $180 billion in federal student loans through various programs, benefiting approximately 4.9 million Americans. This includes $78 billion specifically allocated for around 1 million borrowers through the PSLF program.

In a statement, President Biden expressed his commitment to ensuring that higher education serves as a pathway to the middle class rather than a barrier to opportunity. He highlighted the positive impact of loan cancellation on millions of individuals across the country, enabling them to pursue entrepreneurial endeavors, save for retirement, and pursue life goals that were previously hindered by the burden of student loan debt.

However, despite these significant efforts, President Biden has faced challenges in delivering widespread relief to millions of other Americans. His initial attempt at mass loan cancellation was blocked by the Supreme Court, and his subsequent efforts have been met with legal challenges from Republican-led states. In October, President Biden proposed a new rule that would provide loan forgiveness for individuals experiencing various forms of financial hardship, though the implementation of this rule remains uncertain.

As President-elect Trump prepares for his second term in office, he has not yet outlined specific plans regarding student loans. However, during his campaign, he criticized President Biden’s loan cancellation initiatives as illegal and “vile.” Republicans in Congress have also voiced opposition to President Biden’s loan cancellation efforts, arguing that it unfairly shifts the financial burden to taxpayers who did not attend college or have already repaid their loans.

Overall, the ongoing debate surrounding student loan forgiveness underscores the complex and contentious nature of higher education financing in the United States. While President Biden has made significant strides in providing relief to millions of borrowers, the issue remains a divisive political issue with implications for individuals, institutions, and the broader economy. As the Biden administration nears the end of its term, the future of student loan forgiveness and higher education funding in America remains uncertain.